- Sorry, this product cannot be purchased.

$0.00

See description lower on this page.

Description

Strongest Stocks

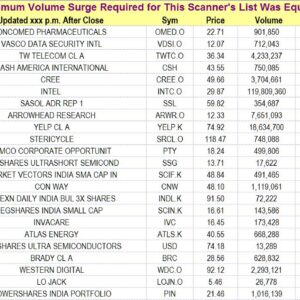

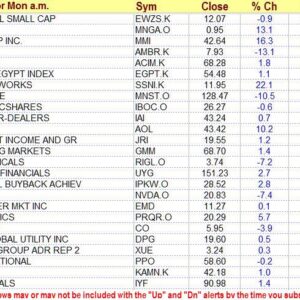

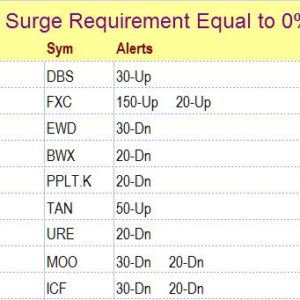

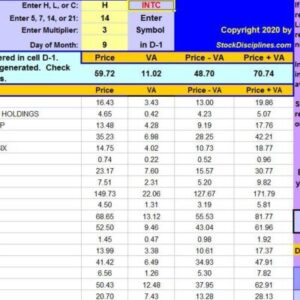

Our “Strongest Stocks” algorithm measures a stock’s strength in such a way that greater weighting is given to stocks that show consistency of “strength.” To do this, our strength algorithm makes a variety of strength measurements. Stocks are then ranked according to their scores. Our company traders prefer to purchase what we call a “Runner” only after a pullback to support (when the stock has pulled back to its rising trendline or to a significant moving average) and only after the stock has begun to rebound from that support. The image above and to the right is an example of a “strong” stock. There are many variations on what a truly “strong” stock looks like to our algorithm. A few more examples can be found by clicking on the “Strongest Stocks” tab of the navigation menu. For whatever reason, these stocks have been exhibiting consistent strength. This is another way of saying that the “market” has shown consistency in favoring these stocks much more than the market as a whole. The strength we are talking about here goes far beyond the “strength” that is measured by the Relative Strength Index (RSI). RSI measurements generally focus only on the last 14 days and cannot detect the most important characteristic of a “Runner,” what we call “durable strength.” Stocks that have the most durable strength are less likely to break down, even in a declining market. Traders often wait for a stock to respond to the support anticipated at the trendline or moving average before they buy in order to reduce risk.

We provide a list of the strongest 100 stocks in approximate rank order. To find a good entry point for those stocks, it is helpful to review them with interval charts (the rate of ascent shown by a daily chart can be intimidating). For example, a twenty-day chart showing 1-hour intervals rather than days reveals the smaller “pullbacks” more common with those stocks.

Inasmuch as The Valuator tracks about 500 stocks and for this service the screen is applied to thousands of stocks, many of the strength candidates found will not be listed in The Valuator. If you want to work only with stocks for which we have valuation measurements, we suggest that you subscribe to The Valuator. That publication includes strength lists based on the same set of algorithms used for this service, and displays the 44 top-ranked stocks covered in that publication. Also, its downloadable spreadsheet can be sorted. That enables subscribers to generate their own lists (of whatever length) of the top-ranked strength stocks covered by that publication. However, The Valuator is a monthly publication. If you need fresh lists more frequently, then the lists provided by our “Strongest Stocks” subscription might be a better choice.

The main menu has a link to “Strongest Stocks” Unless you have already been there, use that link to get additional information.

To subscribe, begin by clicking on “ADD TO CART” at the top of this page.

Return to the “Products & Prices” page

Also, before ordering, read this important message.