Original price was: $25.00.$0.00Current price is: $0.00.

Stops is our tool for calculating volatility adjusted stop losses. It will make calculations based on the Average True Range (ATR) and on the standard deviation. It also will display the True Range and the ATR for 5, 7, 14, and 20 days. It will also generate Fibonacci levels. There is no need to input or download stock price data. Stops does the calculating for you, based on your instructions.

Description

Stops

The following is a very abbreviated description. For a much more complete description, see Stops

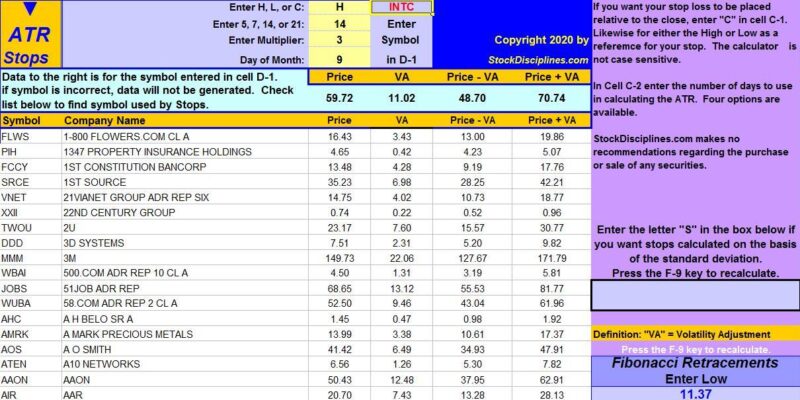

Traders do not want to spend time studying program syntax and non-intuitive procedures that do not follow the standard rules of algebra, and we could find no inexpensive, easy-to-use tool we could recommend that will automatically do the math required to compute the kind of sophisticated stop losses we desired. So, we developed Stops. Stops is based on and makes use of an Excel spreadsheet. It provides two very different ways to compute a stop loss and each of these can be “fine tuned” to reflect the user’s tolerance for risk. All you have to do is enter a few letters (“H,” “L,” or “C”) in cell C-1 to indicate that you want your stop loss calculated relative to the high, low, or close. For ATR calculations, you would enter “5,” “7,” “14,” or “21,” in cell C-2 to indicate that you want your stop loss calculated on the basis of the last 5 days, 7 days, 14 days or 21 days. You would enter a number (usually between 1.000 and 4.000 in cell C-3 to “weight” the volatility measurement (volatility x 1.58, volatility x 3.25, etc.). Cell C-4 displays the day of month on which the data was updated. Data is always collected after the close of market. That is, if data were collected today after the close of market, and today is June 30, the number 30 will appear in Cell C-4.

As you can see in the above illustration, the user can enter a stock’s symbol in cell D-1, and the desired data will appear in the blue area. Alternatively, he can simply scroll down the list to find the stocks of interest. All stocks on the list will show data generated by the settings entered by the user.

In the Goldenrod colored strips, you will see “Price,” “VA,” “Price-VA,” and “Price + VA.” The letters “VA” stand for “Volatility Adjustment.” If a stock has been in a downtrend and an investor is wanting to determine when a reversal has taken place, he might want to calculate a buy price by using a multiple of the volatility measurement. Instead of calculating the price for a stop order to sell, he may want to calculate a price for a stop order to buy. Also, there are times when short sellers will want to add the VA rather than subtract it. In these situations, the “Price + VA” column will be useful. Those who use the tool only for calculating stop loss prices for long positions will focus on the “Price – VA” column.

The above illustration shows the tool configured for ATR stop losses. These are stops based on Wilder’s original formulas for Average True Range. Stops does not modify or corrupt Wilder’s methodologies or use the shortcuts often used by others. It uses his procedures of calculation as he intended. Note the gray box in cell G-19. If the user enters an “S” in that box, Stops will re-configure itself to generate data based on the standard deviation. Entering an “S” in that box changes the top left corner from ATR Stops to SD Stops.

Standard Deviation Stops

With the “S” in cell C-19, Stops will ignore any entries in cell C-2. All computations for the standard deviation will be based on 21 days of price activity.

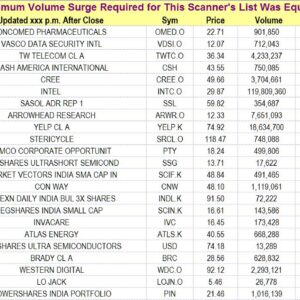

Stops will also show you the data used in computing stops. When the user scrolls to the right, he can view the following data.

The user can see the ATR for the 5-day, 7-day, 14-day, and 20-day periods for all the stocks in the Stops database. He can also see the standard deviation of the Wilder True Range and the latest computation of the True Range. Pivot point data does not show in the above image because it was added after the above image was made (see the pivot point discussion lower on this page).

Many investors rely on “eyeballing” charts to decide on a stop loss price (this can be quite sloppy and result in more than necessary loss) or on making their computations manually. Any manual calculations are likely to be very rudimentary because the more sophisticated computations are very time-consuming. Rudimentary stop losses are usually the first to get triggered unnecessarily because of market “noise.” These stop losses may also give up far too much money when they are triggered. Even one excessive loss of .65 on a 500 share trade would cost more than the price of using the tool for a full year. Multiply that by the number of positions incorrectly stopped out in a year to get an idea of the potential savings possible with Stops. The beauty of Stops is that it provides the more sophisticated stop loss calculations without you having to know how to write volatility measurement formulas and without you having to learn arcane program syntax. You simply enter instructions and Stops will do the rest based on the simple instructions you give it.

Most successful investors prefer to place their stop loss just below a recent minor low. A minor low suggests that there is support at that level. An alternative approach is to place it under a significant trendline. However, there are times when the trader can find no recent minor lows or trendlines to use as a reference. At such times, a “mathematical stop loss” can be very useful. Stops can make computations that are based on statistical probabilities. That is, measurements of dispersion like the standard deviation enable a person to adjust the probability of the stop loss being triggered. Thus, by applying the appropriate multiplier to the standard deviation portion of the equation, a person can set the stop loss so that it is unlikely to be triggered because of the normal volatility of the stock within 50 days, 100 days, or whatever. See “The Probability of a Stop Loss Being Triggered” at the bottom of this page for more information.

Stops has a Multiplier function (cell C-3 in the first two images above) by which you can adjust the number of standard deviations or ATRs that will be used when the stop loss is computed. This tool can be used to find optimum stop losses. The key is to use a stop loss that is as close as possible to the current price (to minimize loss if the stock suddenly plunges) but that is not so close that it is likely to be triggered by normal volatility over the expected holding period of the position. When a stop loss is triggered, it should be for a good reason. There will always be some occasions when a stock will have a downward spike, trigger any reasonable stop loss, then climb to a much higher level. It is impossible to completely eliminate such occurrences. Though they cannot be eliminated, they can be made far less likely. Stops is a flexible and easy-to-use tool for generating stop losses shaped by the user to meet his or her own trading needs.

Fibonacci Retracement Levels

It is often difficult to find a good entry point when a stock is moving up strongly. Traders who expect a stock to continue in a strong advance often buy a stock on a pullback to just above a Fibonacci retracement level and place a stop just below it. If that support does not hold, they will be stopped out at a price only a little below their cost. Stops makes it easy for you to determine Fibonacci levels. It should be mentioned that the ATR and standard deviation stop losses are far more reliable than Fibonacci stops. However, Fibonacci levels can be useful for traders focusing on very short-term price movements. As explained above, they can also be useful for determining entry points. To generate Fibonacci retracement levels, enter the high and low prices of the stock’s most recent significant move in the boxes provided. Various Fibonacci levels will be displayed. Calculations are displayed to 4 decimal places. Stops should be below support rather than exactly at or above it for a security in an uptrend. Most traders will place their stops at some distance below the calculated levels. The amount of “cushion” a trader uses will generally depend on tolerance for risk, time horizon, and the particular trading discipline used. For a security in a downtrend (one you have sold short), you would reverse your procedure. That is, the stop should be above the Fibonacci resistance level if you have shorted a stock in a downtrend. In a downtrend, the lowest price reached in the current downtrend should be placed in the “High” box (as illustrated above) and the highest price reached before the downtrend started should be placed in the “Low” box.

Pivot Points

The pivot point is a recent addition to the data provided in Stops. A pivot point is a price level that is used by traders as a predictive indicator of market movement. A pivot point and the associated support and resistance levels are often turning points for the direction of price movement in a market. Prices tend to swing between two levels. For example, if a price is right at the first level of support (“Support 1”), the probability is that it will move back toward the “pivot point” These levels are very weak, and have most relevance for intraday action (day-traders). In an up-trending market, the resistance levels may represent a ceiling level in price above which the uptrend is no longer sustainable and a reversal may occur. In a declining market, the support levels may represent a low price level of stability or a resistance to further decline. Pivot points were originally used by floor traders in setting key levels. Before the market opened, floor traders would calculate the pivot points for the day. With these pivot points as the base, additional calculations were used to set support 1, support 2, resistance 1 and resistance 2. These levels could then be used as trading aids throughout the day. The resistance levels are where sellers are likely to enter the market, depressing prices. Therefore, it is significant if a stock can push its way through the selling pressure. It takes buying demand to push shares higher through levels at which sellers are waiting. Likewise, the support levels are where buyers are likely to enter the market, exerting upside pressure on prices. Therefore, it is significant if a stock declines through the buying pressure. It takes significant share selling for shares to continue dropping, even through levels at which buyers are waiting.

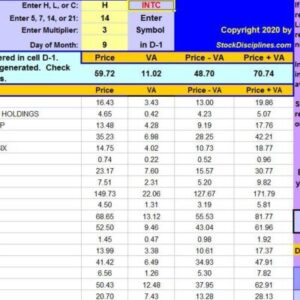

If ypou scroll to the right in Stops, you will see the following.

Where S1 and S2 are the first and second levels of suppot, and R1 and R2 are the first and second levels of resistance. The pivot point is located just to the left of “Ticker Symbol” column. However, it is not necessary to scroll to the right and look up the pivot data for each stock. When a symbol is entered in cell D-1, the pivot point data for that stock is automatically shown in Cells G-41 to G-51 as follows.

If an incorrect symbol or if no symbol is entered in Cell D-1, then there will be no data in the Pivot Data Module of Stops. Where the blue numbers are located in the above image, there will be blank spaces.

To use Stops, you must have a copy of Excel on your computer. However, you cannot open Stops in Excel because it is a stand-alone executable file. You simply click on it and it opens. Each day, the user downloads an updated Stops file. It takes less time to download Stops than it would normally take to download data. All data in Stops is updated daily when the site is updated.

1. There is within Stops all the data needed to generate stop losses for virtually any stock traded on any U.S. exchange. We generate new data daily, transfer it to Stops, and provide these updated copies of Stops on a daily basis. The updates occur when we update the data for all subscribers after the close of market. Conventional stop loss calculators require that the user enter Open, High, Low, and Closing prices every day. Doing this every day for all the stocks in a portfolio can be a time-consuming chore. Now, the user of Stops does not have to do any of that, because the user gets fresh data automatically on thousands of stocks when he downloads Stops. There may be a few expensive programs out there that will download the data rather than requiring manual data entry. However, we believe that downloading Stops will take less time than those programs would require to download data. For an example, try downloading the sample copy of Stops. We found that the Download took us approximately 5 seconds. The time will vary, depending on the configuration of your system, but the download time is very quick.

2. The management of a list of stocks that will be tracked by the calculator is eliminated, because it is not even necessary for the user to add stocks to or delete them from a list for tracking purposes. Virtually all stocks traded on a U.S. exchange are included in each copy of Stops, and the data on each is current. The user can either scroll down the list of stocks or he can simply enter the symbol of the one for which he wants the data.

3. There is no longer a need for the user to commit to, and pay for, six months or a year in advance. The subscriber can pay on a monthly basis and cancel at any time.

4. Stops will show stop loss placement relative to the high, low, or close, and the user can apply a virtually unlimited range of weightings to the volatility measurement.

5. Stops can calculate for long or short positions.

6. Stops can calculate Fibonacci retracement levels and pivot point supports and resistances.

7. We no longer tie Stops to a single computer of the user. If the user has two computers, he can use Stops on either or both. Stops can be used on any computer that has Excel 2003 (or later) installed on it. However, Excel cannot be used directly to open it. The user simply clicks on the Stops icon and it will open with the required Excel spreadsheet.

Thus, Stops is now a subscription service for which the user pays a monthly fee just as subscribers do for any of our other subscriptions. A person can cancel at any time. When an individual cancels a subscription, the cancellation will become effective at the end of the current paid-for period, and the subscriber will have access until then. There is more information about this on our “Refunds & Policies” page. Each day, the user downloads an updated Stops file. This tool is extremely easy to operate. It is fast, it is time-efficient, and it does the calculating for you.

Ordering Stops

A couple can get a 1-day ticket to Disneyland for $234. For that, they may get a few rides and have the privelege of buying things in the park. Once that is spent, it is gone. On the other hand, a subscription to Stops for 6 months costs much less, and it can be used to increase your assets rather than diminish them. Stops has the potentential to save the user far more than its cost. Think of it this way. If yopu save only $1 per share on a single 500 share position by selling a little earlier when a stock begins a decline, you will save about $500. Hypothetically, you could multiply that by the number of positions in your portfolio. Also, when you replace those positions, there is the possibility of saving on the new positions as well. Of course, we cannot guarantee that you will save anything on any position, because so much depends on how you use Stops.

Click on the following link to get an old copy of Stops with out-of-date data. The out-of date sample will enable you to get a sense of the look and feel of Stops. However, the old copy lacks the Fibonacci and Pivot point modules that were added later. It is recommended that Mac users download this sample to check the compatibility of the calculator with their system. Get the out-of-date Sample

Below, you have two selection possibilities, according to whether you have a 32-bit or 64-bit version of Excel. Be sure to order the correct version of Stops. Even if you have a 64-bit Windows operating system, you may have a 32-bit version of Excel. The appropriate version of Stops depends on what version of Excel you have installed on your computer. A 32-bit version of Excel cannot work with a 64-bit version of Stops. Excel 2003 and 2007 are both 32-bit. Later versions could be either. The default option below is 32-bit. Be sure to change that if you have a 64-bit version. If you are not sure, click on Excel Version. After you have selected either 32-bit or 64-bit, please indicate the version of Excel that you are using.