Original price was: $25.00.$0.00Current price is: $0.00.

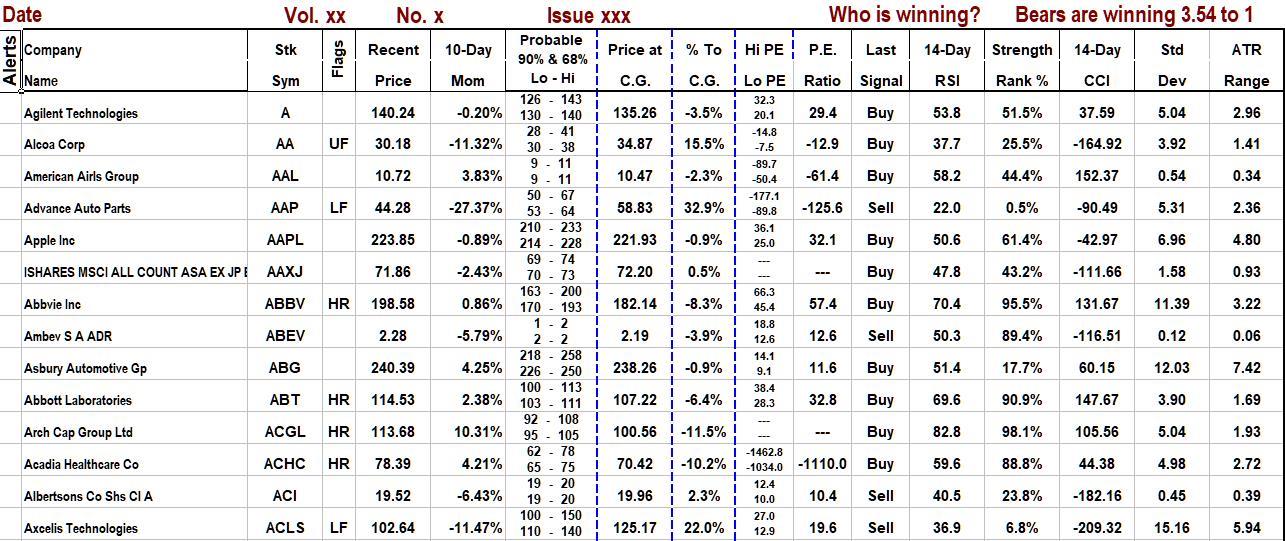

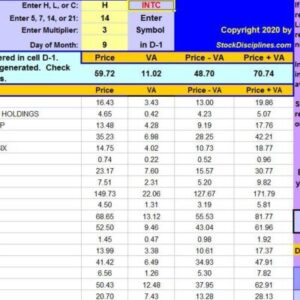

The image to the left illustrates the expanded version of The Valuator.

Description

Explanations

Selecting The Stocks To Track To create the list of stocks to be tracked in The Valuator, we start with the Reuters database of over 8,000 stocks. We filter out all preferred shares (there are thousands) because it is very difficult to find charting programs that recognize the symbols of preferred shares. If a company has preferred shares, it has common shares. We also filter out stocks that do not trade on the day we create or update our list. Such stocks either have extremely low liquidity, the exchange has halted trading, or the stock has been de-listed. The company may also be under investigation by a regulatory authority. When we finish with the filtering, we still have more than 4,000 stocks. We then rank the stocks in terms of the dollars traded per day. Finally, we selected the 1,050 highest ranked stocks on the list. Because of the daily dollar amount traded, we consider these to be the most important stocks traded on the market. The number of stocks being tracked by us at any given time will vary because of mergers, de-listings, additions, etc. This publication is updated weekly.

Explanation Of Column Contents

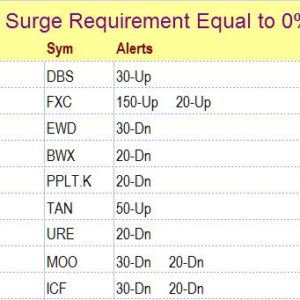

Alerts If a stock can rise 10% or more before reaching its C.G., a “►” is displayed at the far left. If a stock can rise 6% or more, before reaching its “Center of Gravity” or “C.G.” (see below), a “♦” is displayed at the far left. However, a stock with an “♦” alert may continue rising after it reaches its C.G. and end up returning 20% or more, just as a stock with a “►” alert could end up returning 20% or more. That’s because stocks tend to swing above and below their C.G. These indicators are not recommendations. They only highlight stocks that might warrant further attention. A stock that is flagged with “►” or “♦” may fall even further below the C.G. These alerts are given so you can focus your attention better. Monitor these stocks and wait for them to begin a definite uptrend before you consider them for purchase. You should be interested only in stocks that are low and rising, not in stocks that are low and falling. Even with low and rising stocks, there may be overhead resistance that would make a purchase inadvisable. Always look at a chart before making a decision. Look at the bottom half of the “Stock Alerts” page for examples of “setups.” Learn how to identify resistance. Read our tutorials.

Company Name & Symbol These headings should all be self-evident.

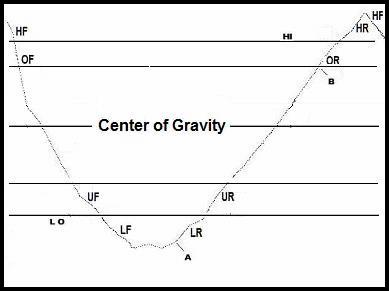

Flags This column shows where a stock is in its cycle. “Flag” defines eight positions in a stock’s cycle: 1. “HF” = High and falling, 2. “OF” = Overpriced and falling, 3. “UF” = Under-priced and falling, 4. “LF” = Low and falling, 5. “LR” = Low and rising, 6. “UR” = Under-priced and rising, 7. “OR” = Overpriced and rising, and 8. “HR” = High and rising. Refer to Column “G” for clarification. It gives two price ranges for each stock. If a stock is below its highest low, we consider it to be “under-priced” and give it a”U” label. Likewise, if it is below its lowest low, it is “low” (“L”). If it is above its lowest high, it is “overpriced” (“O”). If it is above its highest high, it is “High” (H”).

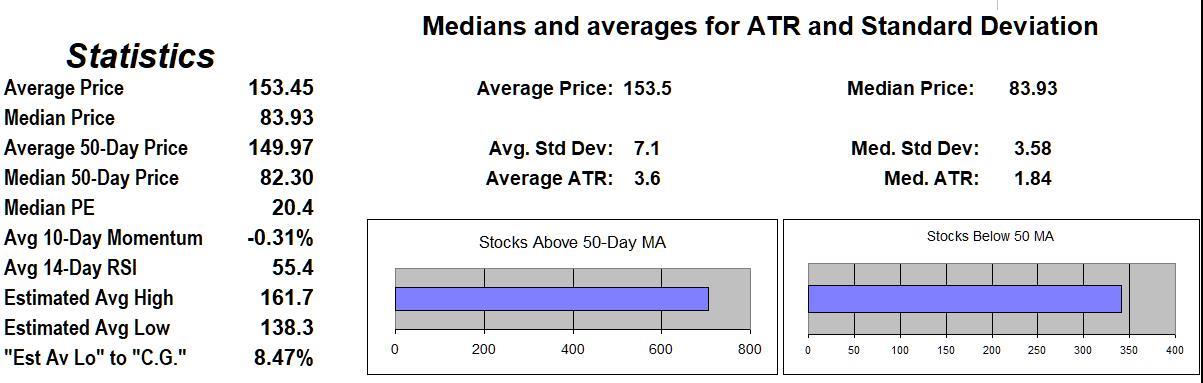

10-Day Mom This column shows momentum. Here, it is the percentage change of the stock’s price over the last 10 days.

Probable Low – High This is based on the pattern of the probability envelope of price action over the most recent 50 days. The “mean” in this case is the 50-lday moving average. The prices given are based on calculating one standard deviation above and below the C.G. There is a 68.26% probability that the price will range between these two extremes, and a 31.74% probability it will move outside this range (15.87% probability above and 15.87% probability below). We dropped numbers to the right of the decimals. We did not average up to the next round number. ===========

Price C.G. We no longer worry about “Fair Value” as determined by analysts (it takes too long to find out if the stock is going to get there, and it is also too “iffy,” because it depends so much on the analyst’s interpretation of whatever data has been given him, as well as the accuracy of his predictions about future earnings, how old his analysis is, and so on). Instead, we now calculate the stock’s price “Center of Gravity.” It is the price of central tendency about which the stock’s price fluctuates, somewhat like a moth’s orbiting of a light bulb. It is the price to which the stock is most likely to return in the short-term or intermediate-term. For this publication we have two calculations. We use the 50-day moving average for the “Center of Gravity” because “regression to the mean” works. We also use linear regression to determine the “Center of Gravity” from another perspective. Both work well for this purpose. [For information on the concept of returning to the mean in stock behavior go here.] Bear in mind that a stock can remain above or below its 50-day moving average for very long periods of time. That’s why a person should do a little research before buying any stock. Also, a person should not buy a stock without it having generated a buy signal or unless it has, among other things, positive momentum. Another important factor is overhead resistance. For example, we would consider it to be foolish to buy a stock for $50 a share if there is resistance at $51 a share. Please see the “Stock Alerts” page for information about “setups.” Focusing on “setups” can greatly reduce risk when buying stocks. Look at the following headings in The Valuator

The second box refers to “Center of Gravity” based on the 50-day moving average. The third, “% To C.G.” is the amount a stock can before reaching its “Center of Gravity.” The fourth box (Reg C.G.) is the “Center of Gravity” as determined by using linear regression, and the fifth box is the percent a stock can rise before reaching its regression-based C.G. Now, lets look at C.G. more closely. What follows is referencing the 50-day moving average C.G. but it applies also to the Regression-based C.G.

% To C.G. (or, “% To Center of Gravity”) This is the amount a stock can rise before it reaches its “Price of Greatest Probability.” If you take a wire or string and stretch it so that it is tightly drawn between two points, then pluck it, the string will vibrate up and down, repeatedly moving across an imaginary straight line connecting the end points of the string. When the string stops vibrating, it will be perfectly aligned with that imaginary line. The “Price Center” is the “Center of Gravity” (C.G.), “price of Greatest Probability,” or “target Price.” For our model, this is what we use for “Fair Value.” However, it is based on statistics, not on the ruminations of an analyst. It is based on the laws of probability and the actual just-taken measurements of the stock’s behavior. The assumption is that prices tend to “vibrate” or swing above and below the average price (or , alternatively, their regression line). After all, a moving average is, by definition, the mean of all the points in a given period of time. That makes the average the theoretical level of highest probability in that given time period. We refer to the center about which all price swings converge as the “C.G.” Theoretically, from a purely statistical point of view, a stock is much more likely to move to its C.G. than to any other price. A reading of 15% means that the stock must rise 15% to reach its “Center of Gravity.” A reading of -15% means that the stock must decline 15% to reach its point of equilibrium. A strong negative reading means that the stock has been very strong recently. See if it has a high “Strength Rank.” If it does, treat it as you would any high strength stock. We post the C.G. for each stock tracked as well as the median for the entire group of stocks covered. This indicator can be used to locate stocks that are “under-priced” and that therefore have appreciation potential (by returning to their CG). Thus, the indicator can be used in more than one way. Never use it in isolation from other analysis. For example, just because a stock has a large number here does not mean it is ready to return to its CG. Just because it has a large negative reading does not mean it will continue rising. Look at the entire picture, not just at one indicator. Also, look for the combination of a rising 50-day moving average and a decent “% to C.G.” While a stock may return to its C.G. even if the 50-day moving average is declining, your chances are much better with a rising 50-day moving average. (Note: stocks with high “Strength Rank” in a rising market will tend to have a strongly rising 50-day moving average. Check it out.) Also bear in mind that if a stock has a rising 50-day average, the stock is generally rising faster than the average. If the average is falling, the stock is generally falling faster than the average. Also, stocks above their C.G. will tend to get support at the 50-day moving average if they decline to that level. Stocks below their C.G. will tend to encounter resistance at the 50-day moving average if they rise to that level. The 50-day moving average and the linear regression line are calculated differently, and usually result in different numbers. In our tests, both seem to work equally well in calculating a useful C.G., even though buy and sell points are sometimes quite different.

Elaboration

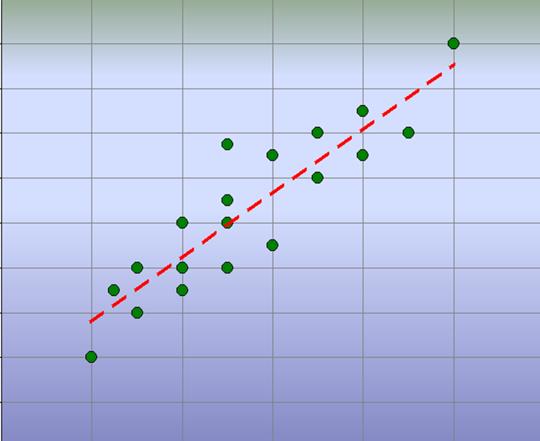

With regard to earnings estimates, a study of more than 67,000 estimates conducted by David Dreman determined that 45.3% of analyst’s estimates missed actual earnings by more than 15%. However, that 15% variance is bi-directional. That is, one stock analyst may estimate 15% more than the actual figure turns out to be and another, looking at the same stock, may estimate 15% less. The measurements you use may vary by 30% from the measurements used by someone else. You may be reaching entirely different conclusions about the same stock depending on which analyst you are using. Instead of using analyst ‘s guesses about future price or “Fair Value” as we did for about 30 years, we now use Center of Gravity as a reference point for the probable short-term price target for the stock. We have two methods of determining “Center of Gravity.” Stocks, whether rising or falling, tend to occasionally return to their 50-day moving average. the 50-day moving average is a favorite of professional investors and traders. Stocks tend to swing above and below this average over time. This average can therefore be considered to be the short-term “price of highest probability.” Short-term, we consider it to be more useful than analyst estimates. Analyst estimates, besides being often inaccurate, by the time you see them can be 3 months to 6 months old. We also use linear regression as a means of defining “Center of Gravity.” Here is a graph showing a regression line for a scattering of points (for example, the closing price of a stock over a period of time.

On comparing regression analysis with the 50-day moving average as tools determining Center of Gravity, we found that the number of times, over a long period of time, that a stock is enough below the C.G. to give a reasonable profit on return to the C.G., averages out nearly the same for either approach. As we said above, we flag stocks that have positive momentum and can rise 6% or more before reaching their C.G. We also flag stocks that have positive momentum and can rise 10% or more to rise before reaching their C.G. We use different flags for referring to the 50-day moving average based C.G. and for referring to the linear regression based C.G. That way, a subscriber can use either method or both. However, stocks do not necessarily deviate 6% or 10% from their Center of Gravity for both approaches at the same time. Therefore, using both approaches can provide the subscriber with more possible candidates for investment.

Instead of thinking in terms of “undervalued” and “overvalued” relative to “fair value,” we think in terms of “underpriced” and “overpriced” relative to the “price of highest probability.” We can look at the average price as the “price of highest probability” or “Center of Gravity” for the stock. Prices tend to return to the mean (average). They also tend to return to their regression line. That they will return to their C.G. is a “guess” just as earnings estimates are based on guesses. However, our data for the C.G. (as determined by either method) and other data in The Valuator are current and accurate (not guesses) at the time of publication, not up to 6 months old. For more on “Center of Gravity,” go Here. For more on “Return To The Mean” investing, go Here

Hi PE – Lo PE Here we take the earnings over the last 12 months and compare that figure with the high price and low price over the same period to compute an approximate high PE ratio and low PE ratio for the last year. Some like to take the average of the low and high figures as an estimate of “Fair Value” relative to earnings. Thus, the high PE would indicate “Very Overvalued” and the Low PE would be “Very “Undervalued.” The region between the average PE and the High PE would be the overpriced range. Thus, the distance the current PE is above the average PE is the amount the stock is overpriced relative to fair value. A similar approach could be used for the range between the average PE and the Low PE in determining the amount a stock is undervalued.

P.E. Ratio This is the current PE-ratio.

Last Signal This column reports the last signal generated by Donchian’s dual moving average crossover system. If the 5-day moving average last crossed from above to below the 20-day moving average, the word “SELL” will be displayed. If the latest cross of the 5-day moving average was from below to above the 20-day moving average, the word “BUY” will be displayed. These are not recommendations. Rather, they are the signals generated by Donchian’s system. If the crossover occurred months ago, but there have not been any crossovers since, the latest signal will continue to be displayed.

14-Day RSI Wilder’s 14-day Relative Strength Index.

Strength Rank % This is a percentile ranking. For example, 90% means the stock is stronger than 90% of the stocks being covered. It measures recent stock strength and gives greater weighting to stocks that show more consistency in their recent performance. A proprietary algorithm is applied to at least 4 separate measurements to derive this figure, and then the combined scores are ranked relative to each other. We have made extensive use of “Strength Rank” in developing our own watch lists. We track the stocks identified by The Valuator as having a high Strength Rank and monitor some of the strongest, waiting for pull-backs. Even when investing in these stocks, investors should wait for a pullback (they should try to time their entry to coincide with when the stock has pulled back to its rising trend-line and then wait for a “trigger event.” The trigger event would be a sign that the stock is rebounding off its rising trendline. In other words, new buyers are accumulating the stock. Some stocks highly ranked in this column may have simply gapped to a higher level because of speculation related to a possible takeover by another company. Such stocks may have limited upside potential. Whether or not this is the case for a particular stock can be determined by a visual inspection of its chart. We tend to avoid stocks that have suddenly started trading at a much higher price.]

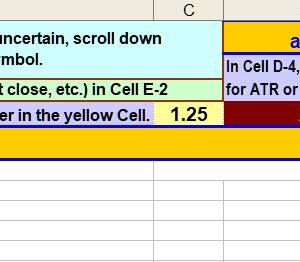

Std Dev This is the standard deviation of the stock over the last 50 trading days. This figure can be used to position stop losses based on the stocks own normal volatility. Usually traders multiply this number by a certain amount (1.5, 2.0, 2.5, etc.) then subtract the result from the recent high, low, or close to locate the sop loss. Experiment a little to see what multiple of this figure works best for you. We have some illustrations of several multipliers for the ATR on our page discussing Stops, our stop loss calculator. If you scroll down the page you will see how different settings place the stop loss in relation to the stock’s pattern of behavior. There is also good instruction there about how to manage your stop loss, so we recommend that you read it all. The calculator is NOT available at this time, but you can see the illustrations by going here

Avg True Range The Average True Range (ATR) is a measure of the average change in price from one day to the next. The ATR does not take the actual change in closing price each day and average those changes. Instead, the ATR is determined by computing the maximum of several ranges from one day to the next. This range is generally greater than the actual change in closing price and it factors in any price gaps from one day to the next. The Average True Range (ATR) we post is the average of the True Range of a stock over the most recent 14 days. This figure, or a multiple of this figure, if often used to determine the placement of a stop loss. See illustrations here

Who is Winning? This is located at the top right corner of the spreadsheet. This indicates the ratio between positive momentum stocks and negative momentum stocks.

Return to the “Products & Prices” page